georgia ad valorem tax refund

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Quick Links Georgia Tax Center.

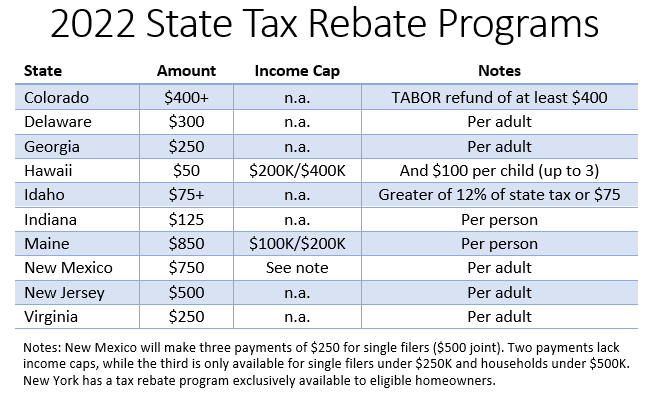

Stimulus Check Update Which States Are Sending A Tax Refund Marca

The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

. Learn how Georgias state tax laws apply to you. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013. Ad Access Tax Forms.

The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis. If a vehicle is used for business the title tax should be added to the cost basis like a sales tax. The information on this page is intended to proved some basic information on the treatment of real estate taxes also known as ad valorem taxes in Georgia.

The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. The basis for ad valorem taxation is the fair market value of the. This calculator can estimate the tax due when you buy a vehicle.

Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Georgia Tax Center Help Individual Income Taxes Register New Business Business Taxes Refunds Information for Tax Professionals. Request an additional six months to file your Georgia income tax return.

Complete Edit or Print Tax Forms Instantly. Related Topics Ad Valorem Vehicle Taxes. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit.

The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. Using the IRS requirements Georgia will permit paid preparers to sign original returns amended returns or requests for filing extensions by rubber stamp mechanical device such. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. For vehicles purchased in or transferred to Georgia prior to 2012 there is still an. If itemized deductions are also.

It is important for property owners to understand the tax and billing process since tax bills constitute a lien on the property on January 1st of each year. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Instead it appears to be a tax in the nature of a sales. Ad valorem tax more commonly known as property tax is a large source of revenue for governments in Georgia. The Ad Valorem Tax or the Property Tax is based on value.

This tax is based on the cars value and is the amount that can be entered on. CHAPTER 5 - AD VALOREM TAXATION OF PROPERTY ARTICLE 4 - COUNTY TAXATION 48-5-241 - Refund or credit of county taxes OCGA. The property taxes levied means the taxes.

Learn how Georgias state tax laws apply to you.

Georgia S Refund Checks Property Tax Break How Much You Ll Get Back 11alive Com

My Tax Return Is So Low This Year When It S Been Generally Bigger Other Years And I Can T Figure Out Why I Worked Full Time All Year I Ve Looked Over My 1040

Form M1pr Fillable Property Tax Refund

Millions Of Low Income Americans Eligible For Tax Refund Boost This Year With The Earned Income Tax Credit Cbs News

Tax Rebates You Can Get Up To 500 In Tax Refunds Under The New Plan In Georgia Marca

Tax Refund Stock Photos Royalty Free Tax Refund Images Depositphotos

18 States Are Sending Relief Payments To Residents Over Inflation

Waiting On Tax Refund What Return Being Processed Status Really Means Gobankingrates

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/07-15-2022/t_c94ac012ea6c415c96ae7e0a566e3695_name_iStock_1139383323.jpg)

Georgia Tax Refund Still Haven T Seen Your Tax Rebate More Are Being Sent Out Soon Wsb Tv Channel 2 Atlanta

How Long Does It Take To Get Tax Refund From The Federal Government Current School News

States Tapping Historic Surpluses For Tax Cuts And Rebates

Tax Rebates You Can Get Up To 500 In Tax Refunds Under The New Plan In Georgia Marca

Where S My State Refund Track Your Refund In Every State

Deducting Property Taxes H R Block

How To Save For Your First Home Buying Your First Home Paying Off Credit Cards First Home

Form M1prx Fillable Amended Property Tax Refund

Here S The Average Irs Tax Refund Amount By State Gobankingrates

Surplus Refund Issued In Georiga Check Your Bank Accounts Youtube

Georgia Department Of Revenue To Begin Issuing Special One Time Tax Refunds The Georgia Virtue